All in one place

Stay up to date

Expand globally

Drive profit through payroll services.

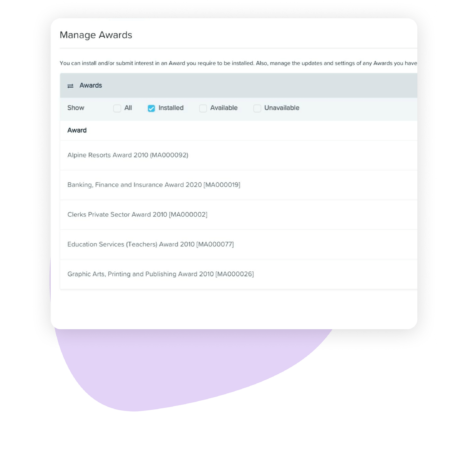

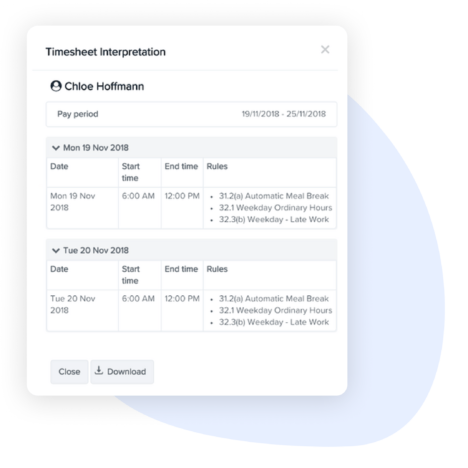

Support with award and payroll compliance

Payroll compliance is ever evolving and complex. Remove the need for manual calculations, spreadsheets, or multiple apps for the interpretation of Australia’s modern awards and leading ATO-certified STP reporting feature. Our modern award interpretation engine can automate employee award calculations - always updated in real time with scheduled legislation changes.

Accounting software integration

Eliminate the need for journal spreadsheet exports and uploads. Integrate seamlessly with a range of accounting platforms including Xero, QuickBooks Online, NetSuite and Saasu. Automate journal entries after each pay run, provision leave liabilities in journals, and map GL accounts with the ability to split by location.

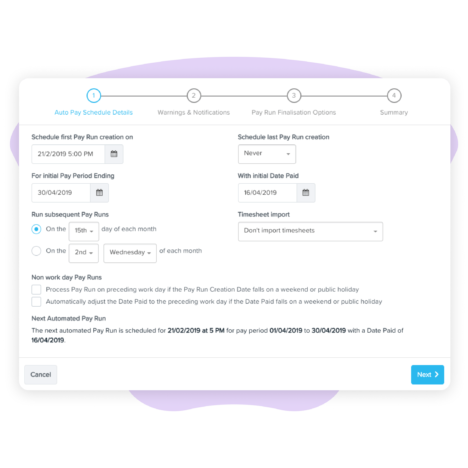

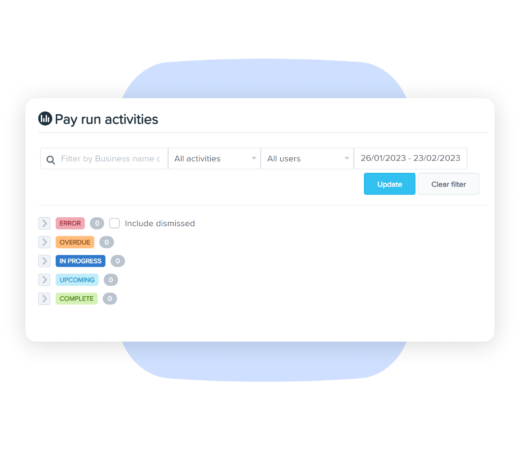

Automate pay runs

Remove all the mundane parts of payroll processing, freeing up time while keeping you firmly in charge. Let pay runs run in the background from start to finish and choose warnings that will stop the automation. Set and forget.

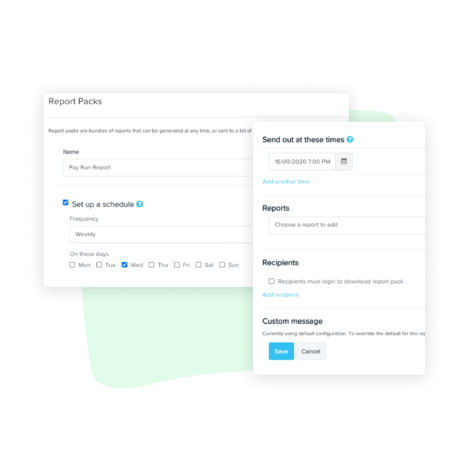

Automate reporting

Add value beyond payroll. Automate the generation and distribution of key reports such as Gross to Net, Leave Liabilities, pay run, super and PAYG.

Timesheet app and time clocking

Accountants often spend hours each month chasing and managing timesheets. Our timesheet calculator automatically interprets timesheet hours for each employee and feeds the data straight into payroll, so you don’t have to.

Trusted by over 750 partners. Here’s why our payroll partners love us.

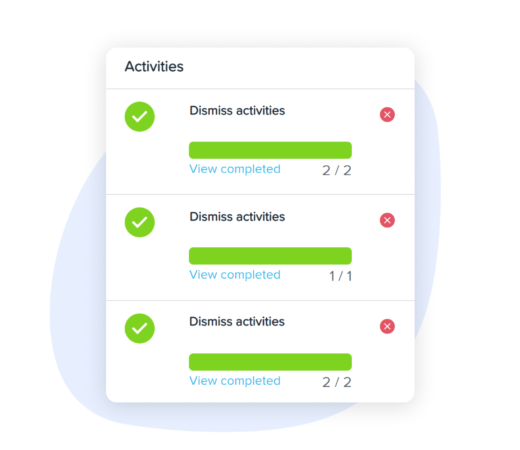

Bureau dashboard

Get overall insights into how pay runs are processed, the state of those pay runs and make informed decisions.

Partner support

Get extensive product support articles, training videos, bite-sized webinars, tools for growth, and much more.