Save time on payroll processing

Stay in control

Quality assurance

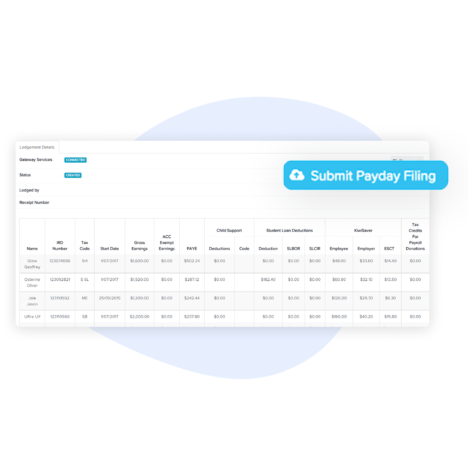

Payday filing

We cover you on all IRD reporting needs at no extra cost. Connect to the Inland Revenue's Gateway Services via an API to submit PAYE data seamlessly. Remove the need to manually upload files via your MyIR portal, easily report new and departing employees, or amend existing employee information.

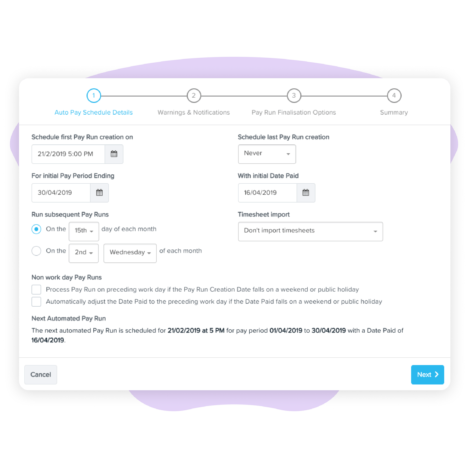

Payroll processing is now fully automated. From start to finish.

Payroll and leave calculations

Transference of data across systems

Public holidays tracking

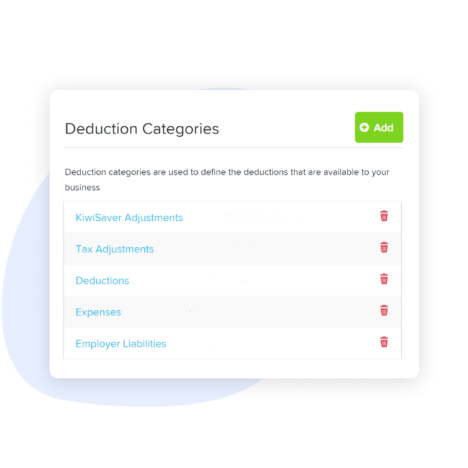

Deductions and Payday filing

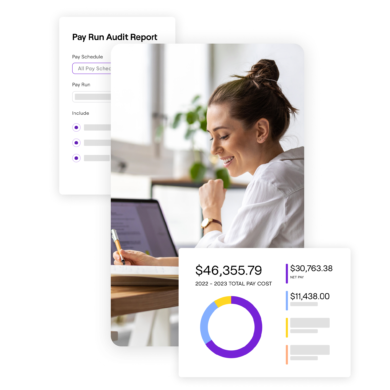

Reporting

Holidays Act (2003) compliant

Made by payroll experts. For payroll experts.

Automated payroll systems FAQs

An automated payroll solution uses software to help managers save time by automatically performing payroll tasks, such as payroll calculations, calculating tax withholdings, generating pay slips and paying employees in just a few clicks.

- Compliance confidence for tax payments – Between payroll taxes, STP, Modern Awards, super stapling, and much more things can get complicated when it comes to staying compliant. When you use an HRIS to automate your payroll obligations, you can have confidence that you’re doing the right thing.

- Seamless integration of payroll services – Increase your business’s efficiency by using a payroll software that will will integrate seamlessly with your current HR software. So you can breeze through payroll with confidence and ease knowing that all your employee data and information is housed together.

- Reduce the chance of human error – Payroll is something you do not want to run the risk of getting wrong. We’re all human, and mistakes are bound to happen. However, using an HRIS (particularly one with AI integrations like Employment Hero) can help automate payroll obligations to help enhance your payroll accuracy and reduce human error.

- Save time on administrative tasks – When done manually, running payroll and bookkeeping can be a time-consuming and mundane task. Thankfully an HRIS can help save you time and allow you to focus on more strategic tasks for your business. Here’s how:

- Payroll automation – Easily calculate penalty rates, overtime rules, and a range of allowances

- Electronic timesheets – Employees can send these to management for approval

- Modern Awards – Payroll software like Employment Hero has built-in award interpretation (over 50 modern awards)

- Dynamic rostering – Allows businesses to allocate their team based on demand and peak times

- Single touch payroll (STP) compliance – Automatically report your tax and super to the ATO with minimal fuss

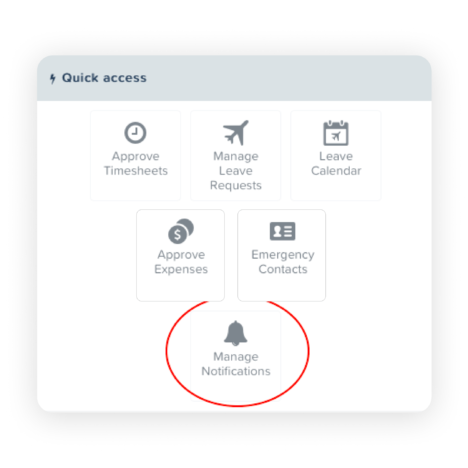

- Empower employees with an employee self-service portal – Whether it’s updating their personal information when changes happen, submitting their leave requests, checking timesheets on their phone or acknowledging important workplace policies, allowing your team to make changes when it suits them takes pressure and admin off payroll officers.

- Save money – When you use an HRIS to automate managing payroll obligations, not only will you save time and money, you can make your payroll process more dynamic and efficient for your business needs.

Automated payroll software collects and processes employee and payroll data from multiple platforms, such as integrated time-tracking systems, accounting software, and HR software.

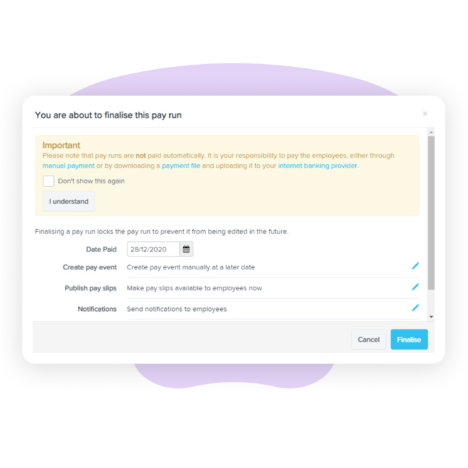

Once a one-off configuration is set, the software then uses this data to calculate employee salaries, wage deductions, and payroll taxes based on local payroll legislation changes, unique employee scenarios and the company’s payroll policies and regulations. Finally, employees are paid straight into their bank accounts, by pay schedule set.

Core payroll tasks such as importing timesheets, calculating pay or sharing payslips can be automated with the help of using cloud based technology.

Cloud-based payroll software like Employment Hero Payroll keeps all employee data in one centralised location and updates in real time. A payroll software with employee self-service also reduces the workload associated with payroll administration. By empowering employees to access and enter their own data and even view their wages, deductions, and benefits, managers will no longer have to chase for data. When using the right cloud payroll system, small business owners, managers and payroll and HR teams can fully automate payroll, as long as one-off configurations have been set.

When looking for an automated payroll service provider, it is important to make sure it is cloud based and has features such as shift management, local compliance with regulations, integration with existing software, employee self-service capability and scalability.

Additionally, you should evaluate the security of the provider’s systems and the support they provide, to ensure that your data is secure and all issues can be addressed quickly.

Innovation, reliability, customer service.

A tick, gold medal, five stars.

over the past year

Resources. All for you.