over the past year

End-to-end intelligent payroll

Next-level payroll automation

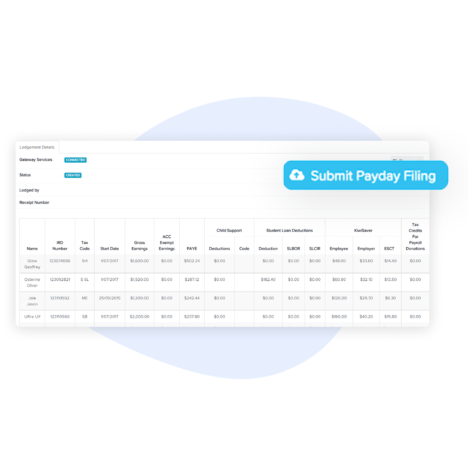

Payroll reporting to IRD

Automated deductions

Payroll like you didn't think was possible

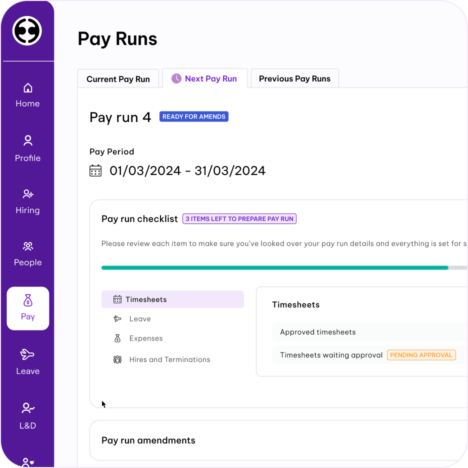

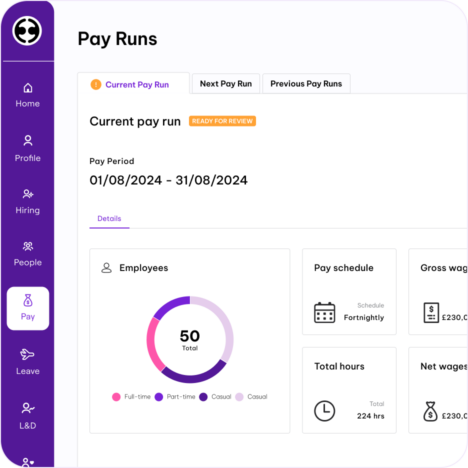

Complex pay run processing made easy

Employment Hero reviews, calculates, and processes your payroll. Once ready, you get notified for a final check with a simple visual dashboard with key information and warned of any errors or discrepancies. Easily submit any revisions or approve the pay run with just a click.

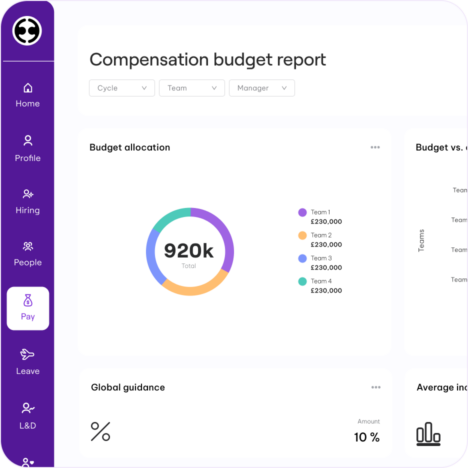

Drive better decisions with powerful insights

No more complex spreadsheet formulas or running blind. Make data-driven decisions with a variety of payroll reports. Access pay run variance, run audits, calculate gross-to-net, and more. Payroll data also allows you to uncover important financial metrics like budget, salary distribution, and payment cycle reports.

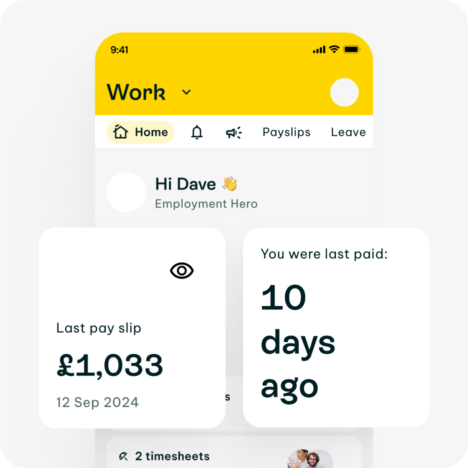

Empower your employees to access what they need

Everyone in your company can access important HR and payroll documents like payslips and employment contracts via Swag, our employee app, or via their Employment Hero account. Past employees can also self-serve important information and documents like payslips, pay details, and employment history via their Hero Passport.

Hear what our clients have to say

Award-winning payroll software

Our award-winning payroll management software is recognised globally for providing outstanding product and customer experience.

Smart payroll integrations

Switch payroll solutions easily by importing employee time worked, leave taken and other employee details from your current payroll provider or accounting software into Employment Hero.

Payroll software FAQs

Payroll software helps businesses automate their payroll processes. This includes tasks like payroll processing, calculation, tax filing, and detailed reports.

Around 25% of SMBs do their payroll manually, and some small businesses think it’s more cost-efficient to not pay for payroll software. Here’s why we feel the opposite is true:

- It reduces administrative mistakes and improves accuracy – Payroll management is complex and prone to errors, especially for small businesses with limited resources. Payroll software automates calculations, ensuring accurate pay, taxes, deductions, and benefits. It also generates automated reports, reducing manual errors and helping maintain compliance with timely statutory reporting.

- Accurate time tracking for small businesses with shift workers – Small businesses often face cash flow challenges, making accurate timesheet tracking and rostering crucial. Errors like overpaying or under-forecasting manpower can have serious consequences. Payroll software helps by automating time tracking, reducing the risk of mistakes, and ensuring compliance. Employees can easily log hours, breaks, and time off, while built-in validation checks catch inconsistencies like overlapping shifts or missed breaks. This minimises errors and protects businesses from costly non-compliance issues.

- Ease and security of having data in the cloud – Payroll software’s cloud-based storage offers secure, convenient access to sensitive payroll data like employee records and tax forms. By eliminating physical paperwork, businesses reduce the risk of loss or theft. With encrypted, password-protected servers, payroll information stays safe, and users can manage payroll remotely, anytime.

Here’s why using payroll software can benefit outsourced providers managing payroll for small businesses:

- Scalable according to business needs – As businesses grow, their payroll needs evolve. Payroll software offers scalable solutions, helping you manage small business clients efficiently as they expand. Manual processes can’t keep up with changes like increased headcount or new locations, but payroll software automates tasks, making it easier to track and adapt. With payroll software, you can handle a larger client portfolio without sacrificing service quality or increasing resources, allowing you to take on more clients and boost revenue while maintaining the same team size.

- Comprehensive tracking and accountability – Payroll software helps you securely track and store payroll data like employee details, earnings, deductions, taxes, and payments, eliminating the need for paper records. This is crucial for outsourced providers, as small business clients often lack proper documentation processes for sensitive payroll information. The software provides a secure audit trail, reducing the risk of data leaks and allowing you to quickly identify and address issues for multiple clients. This ensures you can offer timely advice and services when needed.

- Record keeping according to legislative requirements – Payroll software simplifies payroll record retrieval, eliminating the need to search through files—especially useful for managing multiple small business clients. It securely archives historical payroll data, preserving audit trails as required by law, ensuring compliance with statutory regulations. This makes data access during audits or reviews easy and efficient. Small businesses, often without legal teams, benefit greatly by reducing compliance risks, avoiding penalties, and focusing on growth.